Posted: 3:44 p.m. Wednesday, October 26, 2016

LETTERS TO THE EDITOR

A 0.25-percent earnings tax increase makes ballot Issue 9 a hot button topic for voters in Dayton on Nov. 8. Interestingly enough, the majority of those charged with paying this tax hike live outside of Dayton. What Mayor Nan Whaley is proposing for 70 percent of non-residential tax payers is not what it seems.

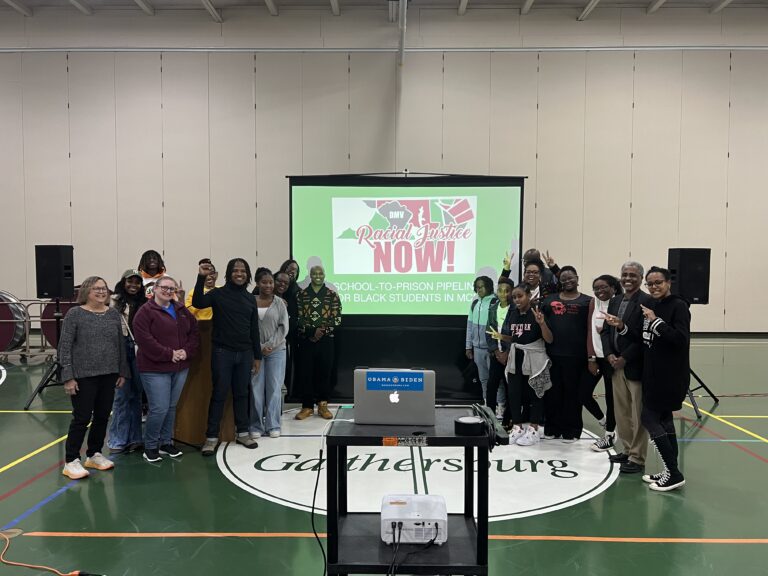

Mismanagement of current budget, over policing of targeted neighborhoods, and feeding the School-To-Prison-Pipeline without any economic value for residents or return of investment for taxpayers is the quick and dirty interpretation of what supporters of Issue 9 are pushing.

This tax increase proposal to close a projected budget shortfall leaves a lot of questions. What has created this projected budget shortfall? Currently the city owns 5,700 vacant lots. What is the plan for those? Could those lots be used to create revenue with a strong community economic development plan?

The city spending millions of dollars of its current budget on old office buildings and commercial properties has been bad business. They are also choosing to support mostly high-end development in the city core, which means they will be driving out lower-income residents. Needless to say, Issue 9 will create a financial burden for those struggling to make ends meet without the benefit or even the promise of increasing opportunities and resources for residents, such as jobs and access to quality food.

Adding more police keeps the focus of lowering crime on stopping crime after it occurs instead of spending on prevention by focusing on poverty and mental health services and reentry programs.

Whaley sells this idea that funding public-to-private partnerships for universal preschool for all 4-year-olds in Dayton strengthens the future of the workforce with quality workers, but hasn’t created a plan that ensures provisions for the students to have fair and equal treatment. Without this type of accountability, the very thing Whaley says the $4 million that will come from the tax increase prevents becomes the inevitable. Students will continue to fall behind, impacting their future economic success. …

Racial Justice NOW! advocates for positive and effective alternatives to address developmentally appropriate behaviors, ensuring students social and emotional well-being and academic, long-term economic success. Issue 9 does not have a plan for this type of accountability and this is why RJN strongly opposes Issue 9.

This tax hike that is sugar-coated with the promise of kindergarten readiness and safer neighborhoods directly supports the School-To-Prison Pipeline and privatization. The City of Dayton doesn’t need more police or the funding of private preschool programs when it has failed to implement quality crime prevention programs as opposed to buying up real estate. Additionally, Dayton Public Schools has a good preschool program. What this city needs is more accountability that ensures fair and effective treatment of its residents with programs and policies to economically invest in high-crime, low-opportunity areas.

ZAKIYA SANKARA-JABAR, DAYTON. Ms. Sankara-Jabar is executive director of Racial Justice NOW!